Introduction

Managing personal finances is a critical yet often time-consuming aspect of daily life. Traditional budgeting and financial planning methods can be cumbersome, prone to human error, and require significant manual effort. AI-driven personal finance apps are emerging as a solution to these challenges. Leveraging advanced data analytics and machine learning, these apps offer personalized insights, automated budgeting, and real-time financial tracking. Research from the Journal of Financial Planning shows that individuals using AI-driven tools experience up to a 30% improvement in financial management. This article explores how AI is revolutionizing personal finance, provides actionable strategies, and highlights how TurboMode AI can help streamline the process by automating task management, allowing you to focus on strategic financial planning.

How AI-Driven Personal Finance Works

- Data Aggregation:

AI apps aggregate data from multiple sources including bank statements, credit card transactions, and investment portfolios to provide a comprehensive view of your finances. - Automated Budgeting:

AI systems learn your spending habits and create personalized budgets that adjust in real time as your financial situation changes. - Predictive Analytics:

By analyzing historical data, AI can forecast cash flow, predict future expenses, and suggest adjustments to avoid overspending. - Investment Advice:

Some advanced platforms provide tailored investment recommendations based on market trends and your personal risk profile. - Expense Categorization:

AI automatically categorizes your expenditures, identifying opportunities for savings and highlighting areas for improvement.

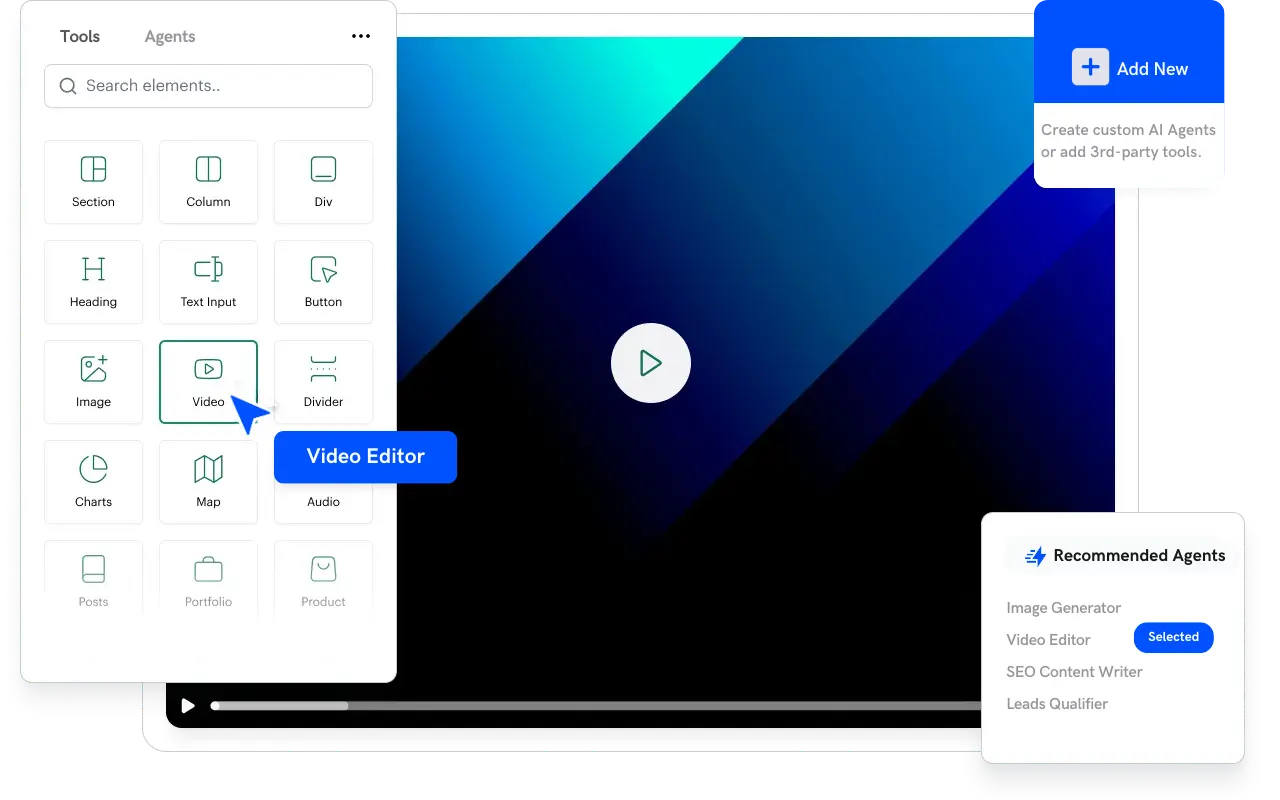

TurboMode AI Spotlight

TurboMode AI can integrate with personal finance tools by extracting actionable items from financial insights and conversations, turning budget discussions into prioritized tasks.

“We’re shifting the game from managing work to getting work done.”

Streamline your financial management efforts with TurboMode AI—book a demo today.

Benefits of AI-Driven Finance Management

- Time Savings:

Automation reduces the need for manual input, saving hours of financial tracking each month. - Increased Accuracy:

By minimizing human error, AI ensures that your financial data is both accurate and up-to-date. - Personalized Insights:

Tailored recommendations help you make informed decisions that align with your financial goals. - Improved Savings:

Clear visibility into spending habits can lead to significant savings, while automated alerts help prevent overspending. - Ease of Use:

With user-friendly interfaces, even individuals with limited financial expertise can manage their money more effectively.

Implementation Tips

- Choose a Comprehensive App:

Look for apps that offer a full range of features—from budgeting and expense tracking to investment advice. - Sync All Your Financial Accounts:

Integrate all relevant financial data sources to get a complete picture. - Set Up Automated Alerts:

Configure alerts for unusual spending, upcoming bills, or budget limits. - Regularly Review Reports:

Use analytics dashboards to monitor your spending habits and adjust your budget periodically. - Combine with Personal Productivity Tools:

Integrate your finance app with platforms like TurboMode AI to automate follow-ups on financial tasks.

Case Studies and Evidence

A case study from a leading fintech company revealed that users of AI-driven finance apps reduced their monthly expenses by 15% on average. Another user reported that automated budgeting and real-time alerts helped prevent overspending during a period of economic uncertainty, leading to a more stable financial situation.

Challenges to Consider

- Data Security and Privacy:

Financial data is highly sensitive. Ensure that any AI tool you use adheres to strict data protection standards and is compliant with regulations. - User Trust:

Trust in automation is crucial. Look for platforms with a proven track record and transparent algorithms. - Integration Issues:

All of your financial data must be synchronized seamlessly for the tool to provide accurate insights. Check for compatibility with your financial institutions and other apps.

Future Trends in Personal Finance Management

- Enhanced AI Recommendations:

Future tools will provide even more granular and personalized investment advice based on real-time market data. - Blockchain Integration:

Combining AI with blockchain could further enhance the security and transparency of financial transactions. - Predictive Financial Planning:

Advanced predictive analytics will offer long-term forecasts that help you plan for major life events.

Conclusion

AI-driven personal finance management solutions are transforming how individuals handle their finances—making budgeting, saving, and investing more efficient and accurate. With the power of predictive analytics and personalized insights, these tools enable smarter financial decisions that can lead to improved stability and growth. By integrating with TurboMode AI, you can automate routine financial tasks and focus on strategic money management. Embrace these cutting-edge technologies to take control of your financial future—book a demo today.